What sort of rally is carbon going to have?

- Alessandro Vitelli

- May 27, 2020

- 4 min read

After March’s vertiginous drop in EUA prices, carbon appears to have found a new level between €18.50-22.00 for the time being, and we’re currently testing the upper bounds of this channel.

Since the start of lockdowns across Europe Dec 20 EUAs have fluctuated mainly between €18 and €22, with healthy buying interest coming in whenever the market dips. Well into May, traders were reporting greater interest from compliance buyers – industrials as well as utilities – at the lower levels, though there appears to be no great incentive to push the market much higher than the low €20s so far.

Prices touched a five-week high of €22.16 on Tuesday, which may have reflected one of several things. Firstly, purely speculative interest seems to be a driving factor in the market at the moment, whether it be based on long-term views of where carbon prices will go, or what supportive policy measures will boost the market.

Secondly, some more short-term issues are arising. We know that French utility EDF is cutting nuclear generation this autumn and winter, and that the current list of confirmed plant maintenance does not yet cover the total amount of lost generation.

This suggests that more outages are set to be announced, with the consequence that the lost power supply will need to be replaced from somewhere. Most people see German coal generation as the likeliest candidate here, which would lead to more demand for EUAs.

(Coincidentally or not, French winter power has seen a price increase in the last day or two in the brokered markets, according to reports.)

In addition, prompt gas prices have arrested their constant decline in the past three days. The TTF June contract reached a low of €3.365/MWh last Friday, rallied to as high as €5/MWh on Monday, though it ended Tuesday closer to €4.

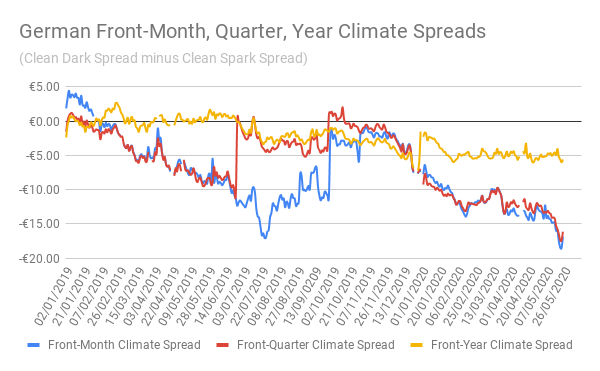

Higher gas prices makes coal relatively more competitive, even if the front-month clean dark spread still looks nightmarish compared to the clean spark. An extended rally in gas could eventually be bullish for carbon. However, we have seen four or five of these gas price “pauses” already this year, so it’s a bit early to tell whether this is a floor for gas.

So has carbon found a floor?

There are a few good reasons why the market should be supported. Firstly, industrials have been keen to buy whenever the market dips. They know that Phase 4, which begins in January, will bring with it smaller free allocations – in some cases reduced by 60% – and a steeper linear reduction factor. So any opportunity to buy EUAs at (relatively) low prices is being exploited.

Industrials like to buy below the average for the year, which currently stands at €21.75, so the support at €19 during early May was pretty understandable, though the buying may fade at these newer levels.

Secondly, compliance installations won’t be able to borrow from their 2021 free allocation to meet their 2020 compliance. Rules covering the transition between phases mean that industrials will need to use Phase 2 or 3 EUAs to cover every last tonne of their 2020 obligations.

It’s worth bearing in mind of the example of British Steel, which borrowed heavily during the current phase, only to be caught out a year ago when the UK was suspended from issuance and allocation in 2019. This meant British Steel couldn’t rely on the annual handout in February 2019 to meet its 2018 compliance obligation and was forced to seek help from the British government to buy essentially a year’s worth of EUAs.

And of course there remains the uncertainty of what the EU institutions will agree in terms of the Green Deal. Wrapped up in this giant project is a review of the ETS – and critically, the MSR – in light of a new 2030 emissions reduction target. Even the headline 2030 number is still unclear: will it be 50%? 55%? Or even 65% as suggested by the Parliamentary rapporteur Jytte Guteland? In any case, carbon looks likely to become much tighter over time.

Even technically, the charts show some positive momentum at present. The relative strength index is moderately bullish, the MACD signal line is still – just – showing an upward trend, and prices are within touching distance of a number of local highs, including the April 17 peak that was the closest we have come to pre-lockdown levels.

RSI (above) and MACD (below)

Above the April high we have a succession of local highs and lows dating back to October that may act as resistances, while the supports are very familiar - levels that the market has tested already this year between €18-19.

So what to expect in June? On average since 2008 June has seen prices end the month within 1% of where they began it, as the chart below shows. Of course, this is not an average June or indeed year; much of what happens is likely to be driven by gyrations in equities, coronavirus news flow (and June will see quite a few lockdown restrictions lifted, at least in the UK), and perhaps the gas market.

We can probably set aside compliance buying for the time being, since prices are probably too close to the annual average for many. But there is always the hand-to-mouth buying from utilities that don’t habitually hedge years in advance, and if temperatures remain as high as they currently are, there will be an uptick in power demand for cooling. Oh, and of course the French nuclear story rumbles on…

And is there a bearish story? Well, all through April and early May I kept thinking there was. I have been reading report after report discussing the outlook for energy demand during and after the coronavirus pandemic, and some of the projections (S&P Platts, IEA, EIA) are pretty bearish.

But power, gas and coal prices are all around 85-92% of their levels at the start of the Great Covid Sell-Off, so pricing conditions have reverted towards where they were before lockdowns began.

Consequently, it's a little difficult to see how carbon prices could fall back to the €18-19 area without a corresponding move in the power complex. And as we head into the peak summer demand season, how likely is that?

Comments